Manage your policy anytime, anywhere

Your online account puts you in control, it’s quick and easy to manage your policy, plus there’s no admin free when you make a change online, and it’s available 24/7!

Your online account puts you in control, it’s quick and easy to manage your policy, plus there’s no admin free when you make a change online, and it’s available 24/7!

We want to make it as easy as possible for you to manage your insurance policy. That's why you can manage your account online 24/7 with no administration charges – meaning you can make adjustments when it suits you. You can:

Step 1

Click here to create your online account. If you already have an online account please log in.

Step 2

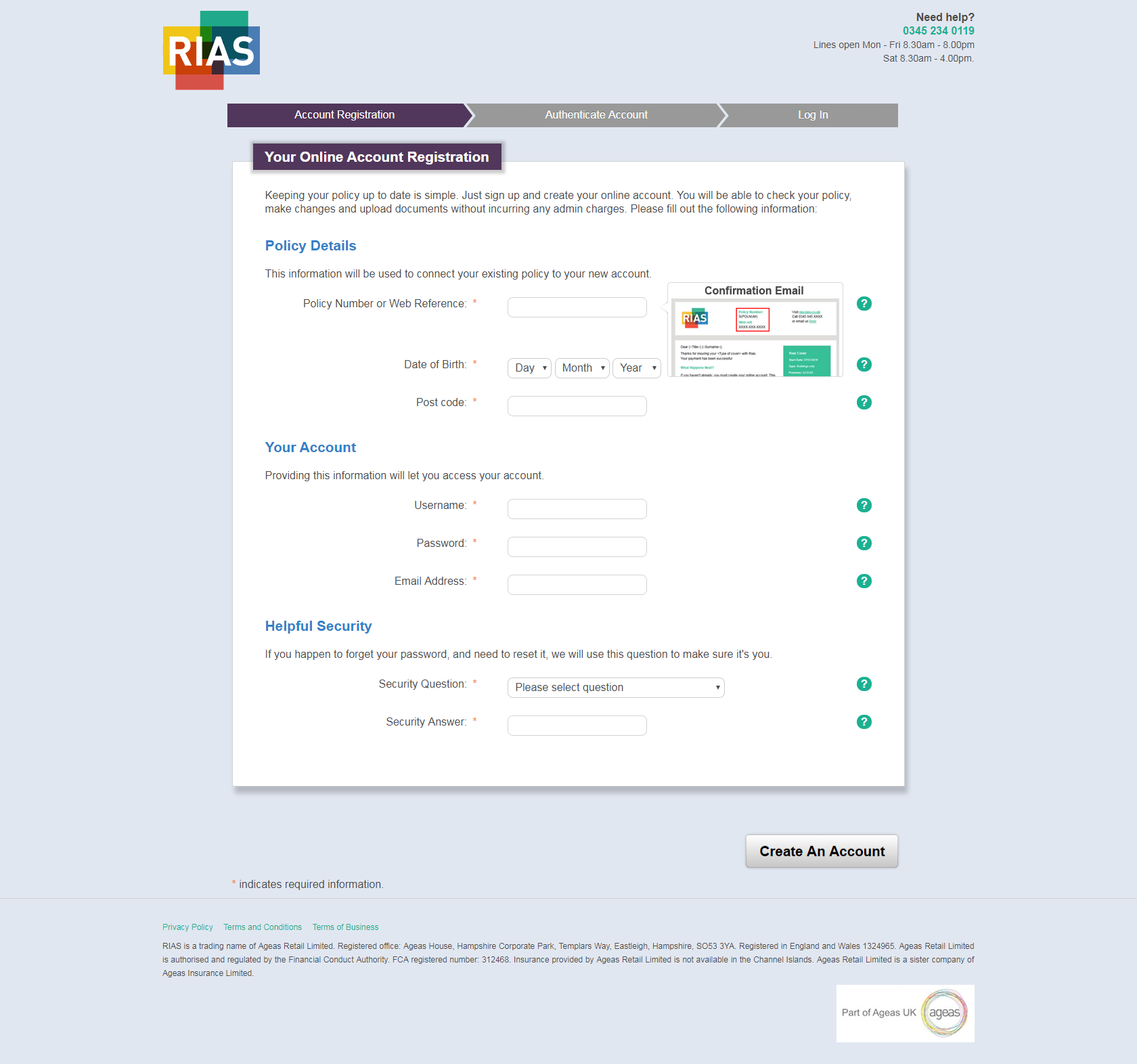

You'll then need to fill in our registration form. Have your policy number or web reference to hand, which you'll find at the top of your welcome email. Just so you know, this is case and format sensitive. Once you've entered all your details, click 'Create An Account'.

Step 3

When you've finished, you’ll see a message thanking you for registering. We'll send you an email to activate your new account shortly afterwards. Please check your spam folder in case it's not gone straight to your inbox. To complete your registration, just click the link in the email and go to the login page below.

Once you've successfully signed in, you'll be able to take advantage of all sorts of online services, including viewing your policy documents, uploading your No Claims Discount documents, and making changes to or renewing your policy.

If you have any other queries about your online account, please use our virtual assistant who will be able to help.

We'll get in touch with you if we need to see proof of your No Claims Discount. If we've already contacted you, you can provide your proof of No Claims Discount by uploading it in your online account. Just so you know, if we ask you for proof of your No Claims Discount, you’ll need to send it to us within 14 days of purchase, otherwise we’ll have to cancel your policy and won’t be able to restart cover for you.

What to do

Once you're logged in, click ‘upload documents’. You can add your No Claims Discount file here, which will be sent to us to review.

Once we’ve received your proof we'll then contact you to confirm it is acceptable or let you know if we need any more information.

What we accept

What we’re after as acceptable proof is either a full renewal invitation, a cancellation letter or a Proof of No Claims Discount letter from your previous insurer. Whichever option you go for, you’ll need to include:

Uploads can be in a variety of formats, including Microsoft Word, PDF or a photo in the following formats: GIF, PNG, JPG, JPEG and JPE. Just make sure your document is less than 3MB.

Make sure that you are using the correct username and password (these may be case sensitive). If the issue persists, use the ‘forgotten username’ and ‘forgotten password’ links to reset these details so you can log in.

You are not able to make changes to your insurance policy in your online account if:

For car insurance policies, you won't be able to make changes until your proof of no claims discount has been accepted, if we have asked for it.

If any of the above apply to you, please contact us on the phone to make your changes. In these instances, we will not charge you a fee for your changes, although your insurance premium may still be affected by them.

You can access your renewal invitation letter, which includes your no claims discount information, directly in your online account - even if your policy has already been cancelled.

Once you're logged in, click ‘Manage policy’ and access the documents section. You can then open your certificate and save it to your computer.

If you have any other queries about your online account, please use our virtual assistant who will be able to help.

The United Kingdom (UK) left the European Union (EU) on 31st January 2020 with a Withdrawal Agreement and subsequently entered into a transitional period which ended on 31st December 2020.

Since the UK Government announced the confirmation of a trade deal at the end of 2020, anyone wishing to drive their vehicle outside of the UK from the 1st January 2021, had been required to carry a Green Card.

The European Commission has announced that with effect from the 2nd August 2021, UK drivers will no longer be required to carry Green Cards when driving their vehicle in the EU (including Ireland), Andorra, Bosnia and Herzegovina, Iceland, Liechtenstein, Norway, Serbia, and Switzerland. Please note that a Green Card may still be required to drive in other countries, including: Albania, Azerbaijan, Belarus, Moldova, Russia, Turkey and Ukraine. For more information, please visit: https://www.gov.uk/vehicle-insurance/driving-abroad.

A Green Card is an International Motor Insurance Certificate which evidences that your current insurance policy provides the necessary minimum level of cover for driving in the EU country you are travelling to or through. While we await further details, it is best to carry your Green Card for all journeys to the EU or EEA. In addition to the basic cover which the Green Card gives you, your insurance policy provides you with full insurance cover for up to 90 days.

You can find more information on our Driving in Europe page.

To add a temporary driver, please use our virtual assistant who will be able to help, alternativey you can contact us by phone.

Before you get in touch with us for a replacement certificate, please make sure you have at least three of the following details to hand:

Your new certificate should be with you by post within seven to ten working days. Unfortunately we can’t email your replacement certificate.

You can view all your documents in your online account. Once you’re logged in, head to the ‘My Car’ or 'My Home' page and click on the ’Your documents’ tab. Here you will be able to see all your documents, to open a document just click on the view button next to it.

There’s no charge to make a change to your policy through your online account. However, you will be charged an administration fee if you choose to make your change by calling us on the phone.

It's worth noting that changes made to your policy may impact your insurance premium, regardless of whether you've made them online or on the phone.

We want to make renewing insurance easy for our customers so we don't offer discounted prices to people who call us. The price we've given you is our final price based on your current cover and information we hold.

Consent to auto-renewal means you are giving us permission to renew your policy without you having to do anything other than check the information we hold for you remains correct. When you give your consent to auto-renew your policy, Rias will issue your renewal documents and inform you that the policy will auto-renew without any intervention from you. The consent will remain in force unless you change it or the policy is cancelled. If you choose not to have auto-renewal, you will need to contact us at renewal to ensure you remain insured. You can change you auto-renew preference at anytime.

Auto-renew gives you peace of mind that your insurance will remain in place when it comes to your renewal. When you give your consent to auto-renew your policy, Rias will issue your renewal documents and inform you that the policy will auto-renew without any intervention from you. The consent will remain in force unless you change it, which you can do at anytime or if the policy is cancelled. If you chose not to auto-renew your policy you will need to contact us to complete your renewal. If you don’t contact us then your policy will lapse and you will not be covered.

You can change your auto-renew consent at any time before your renewal by using your online portal or calling us. There is no charge for changing your mind. If you choose not to have auto-renewal, you will need to contact us at renewal to ensure you remain insured.

'Pay in full' is the cheapest way to pay for your insurance. Because you pay a single annual payment there is no interest to pay as there is with some other payment methods such as direct debit. You can choose to auto-renew your policy if you pay in full.

Pay monthly to help manage your budget however it will cost you more than paying in full with a single annual payment. You can choose to auto-renew your policy if you pay by Direct Debit.

Strong Customer Authentication is a set of regulatory requirements introduced by the Financial Conduct Authority (FCA) which are designed to make online payments more secure for customers. SCA adds an extra layer of security when you make a payment online, offering you extra protection against identity and payment fraud.

The FCA are keen to make transacting online more secure and these changes should reduce the risk of fraud online.

The new SCA process means that the way your bank or payment services provider verifies your identity or validates a specific payment instruction is changing, when you make a purchase online of £30 or more.

SCA is a form of two-factor authentication (2FA) and uses two types of validation out of the three categories outlined below to verify your identity. Using this additional information, SCA checks that you are who you say you are, meaning you should feel confident using your card for online payments.

Two-factor authentication may already be familiar to you if you use online banking or shop online. The most common examples currently include, receiving a text message with a one-time use code, facial recognition or thumbprint id on your smart phone – both of these are an extra check to confirm it’s you making the payment.

There are three ways we can authenticate your identity, but we will only ever ask you for two at any one time, the categories are:

No, SCA is only required for online payments you make of £30 and above.

You should contact your card payment provider who will be able to provide you with further assistance to get this set up.