We'll get in touch with you if we need to see proof of your No Claims Discount. If we've already contacted you, you can provide your proof of No Claims Discount by uploading it in your online account. Just so you know, if we ask you for proof of your No Claims Discount, you’ll need to send it to us within 14 days of purchase, otherwise we’ll have to cancel your policy and won’t be able to restart cover for you.

What to do

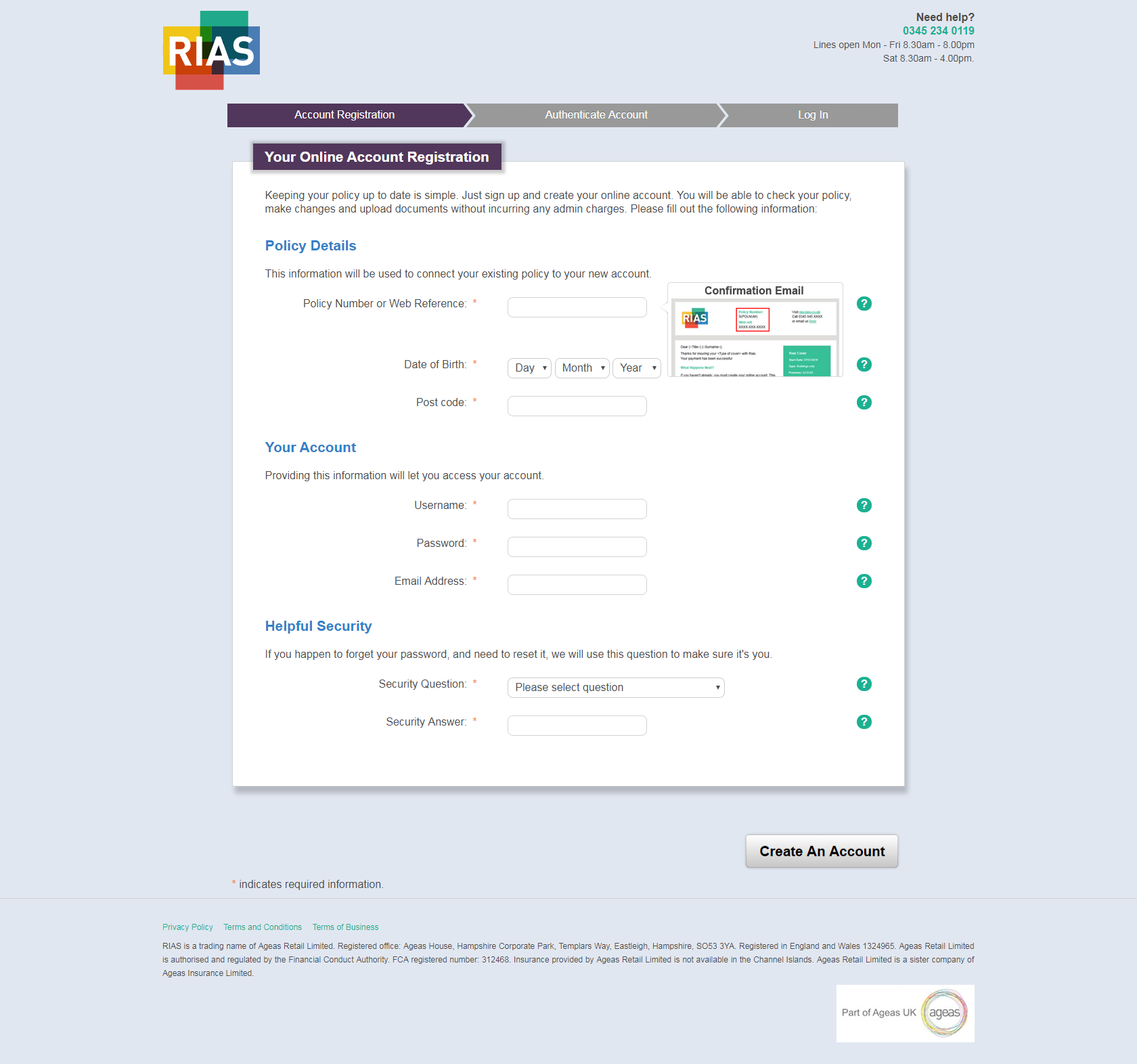

Once you're logged in, click ‘upload documents’. You can add your No Claims Discount file here, which will be sent to us to review.

Once we’ve received your proof we'll then contact you to confirm it is acceptable or let you know if we need any more information.

What we accept

What we’re after as acceptable proof is either a full renewal invitation, a cancellation letter or a Proof of No Claims Discount letter from your previous insurer. Whichever option you go for, you’ll need to include:

- A letterhead that clearly identifies your previous insurer

- Your previous policy number

- Your previous policy expiry date

- Your name and full address

- Your No Claims Discount in years

Uploads can be in a variety of formats, including Microsoft Word, PDF or a photo in the following formats: GIF, PNG, JPG, JPEG and JPE. Just make sure your document is less than 3MB.