Saturday, 01 July 2023

Five garden games for the whole family

It can be great fun on a warm summer’s day to get out into your garden and play a few games with your family. Here are some of the best, including some that are free and a few that are fairly cheap. Some may need a little DIY to set up, if you’re up for it.

Wednesday, 12 October 2022

Why have fuel prices risen so high?

We look at the rise in fuel prices, but while prices have begun to fall, filling up your car is still an expensive business. So, what are the key reasons behind soaring costs, and how can you make savings?

Tuesday, 16 August 2022

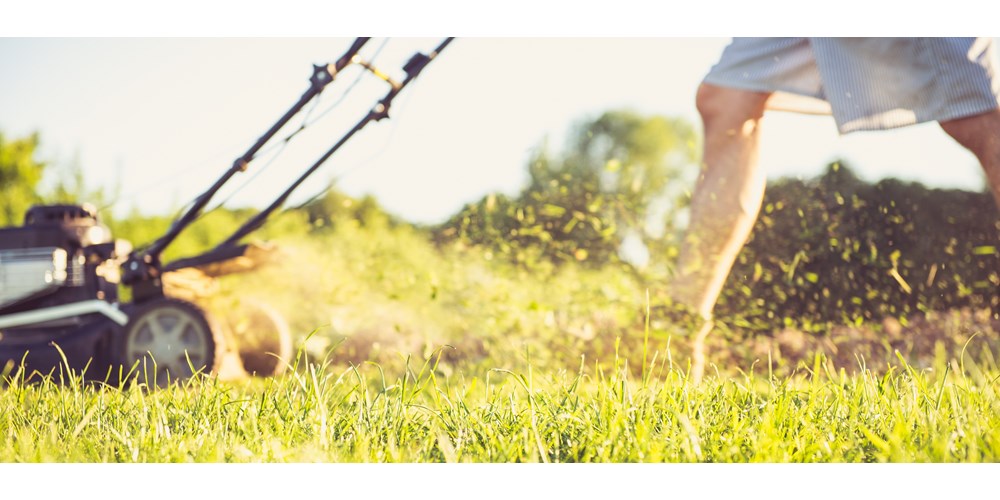

How to keep your lawn looking green and healthy

Ever wondered how to get a luscious looking lawn? Lawn perfection just requires some planning and regular maintenance, here are our top tips to help you achieve it.

Wednesday, 13 July 2022

How to care for your house plants

House plants are an inexpensive way to brighten up your home. They can also help create a sense of calm and wellbeing , potentially improving your mood and reducing your stress .

Thursday, 05 May 2022

How to save money on DIY

It’s surprising how DIY can quickly become more expensive than you expect, as there’s many things you’ll need - from tools to materials. So here are some tips to save money when embarking on any DIY project, big or small.

Tuesday, 05 April 2022

Five of the best super cars in 2022

If you're into super cars, here are five of the best sports cars coming out in 2022 if you're ready to dream, or you have some serious budget to blow.