Friday, 27 June 2025

How to save water at home and in the garden

As we enter the hotter months of the year, it’s a good time to try and save water when we can. Saving water is great for your wallet, the environment, and your plants. Here are some simple ways to help you save water at home and in your garden.

Tuesday, 24 June 2025

Home insurance and your garden

For many of us, our garden is a special part of the home. It’s become a valuable living space where we can relax, have barbecues, and enjoy time with family and friends. But have you considered whether your home insurance extends to your garden and what might be covered? This guide looks at the type of insurance you need to keep your plants, tools, and furniture protected.

Monday, 23 June 2025

What does Apple CarPlay do?

Apple CarPlay mirrors your iPhone features to your car’s display screen so you can make calls and listen to music without touching your phone. Our comprehensive guide tells you what CarPlay can do, whether it will work in your car, and what to do if you use an Android phone.

Wednesday, 23 April 2025

How to transfer car ownership

If you’re selling your car – or gifting it to someone – you’re required by law to let the DVLA know about a change of ownership. Discover how to go about this using your V5C, or logbook, and what happens if you fail to notify the DVLA.

Friday, 28 March 2025

The most reliable used cars - with high mileage

It’s possible to bag a bargain when buying a used car with high mileage. On the other hand, the vehicle could turn into a money pit if it turns out unreliable. Read our handy guide on what to consider when looking for the most reliable used cars and the best high mileage cars on the market.

Friday, 28 February 2025

How to protect yourself from phone scams

Want to avoid being the victim of a phone scam? Find out what these scams look like, ways to protect yourself and how to report any suspicious contact.

Thursday, 23 January 2025

Flood & Freeze: What is covered by your insurance policy

Keeping your home in good repair and doing a few regular checks in the most common problem areas will help prevent damage that could otherwise creep up on you. Find out what is covered by your insurance policy.

Monday, 23 December 2024

Winter Car Maintenance

Wintry weather can take its toll on cars and difficult driving conditions can catch you by surprise. But with a bit of planning, you can ensure your car is ready for the winter weather. Below we provide a run-down of essential maintenance tips.

Wednesday, 20 November 2024

Windscreen chips - what you need to know

Getting a chipped or damaged car windscreen is a hassle every driver would rather avoid. It typically happens when stones or gravel are thrown up by the tyres of other vehicles.

Wednesday, 20 November 2024

Why roof damage claims might not be covered

It’s important to keep your roof in good repair. Regular checks on your roof will help prevent damage and the chance of leaks during bad weather, keeping it in good shape and avoiding any long-term damage.

Wednesday, 24 July 2024

Tips for driving in a heatwave

Extreme heat is still relatively new for us in the UK, but it can negatively impact vehicles, drivers and passengers when temperatures soar. Here are some tips for driving in the heat.

Wednesday, 17 July 2024

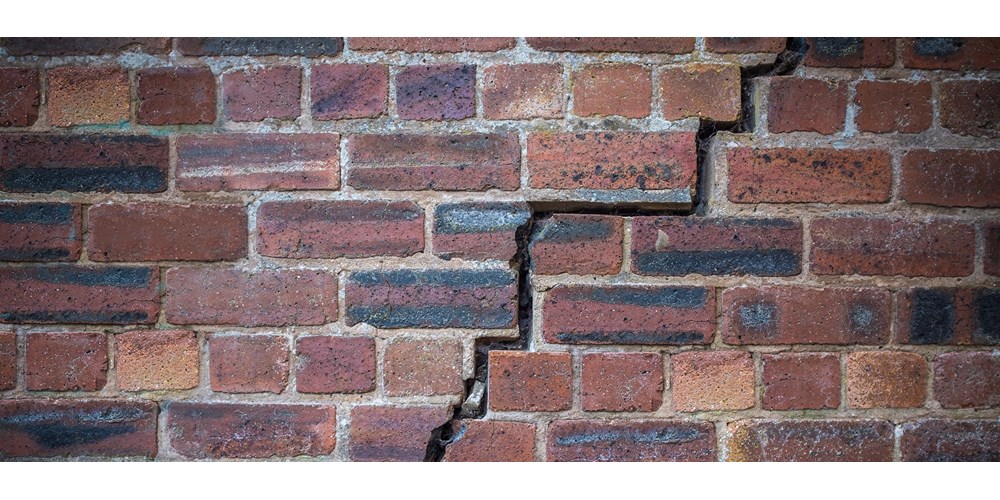

What do subsidence cracks look like?

Find out how to spot subsidence cracks and what to do about them.