PROTECTING YOUR HOME FROM A FLOOD

With the increase of weather events in the UK, we're here to help you protect your home and offer support if your home is affected.

FLOOD DAMAGE PREVENTION CHECKLIST - EXTERNAL

1. Landscaping - can help divert water away from the building

2. Flood gate - consider installing at your door

3. Flood sacks – add these to both sides of your door

4. Flood boards – fix these to your doors and windows.

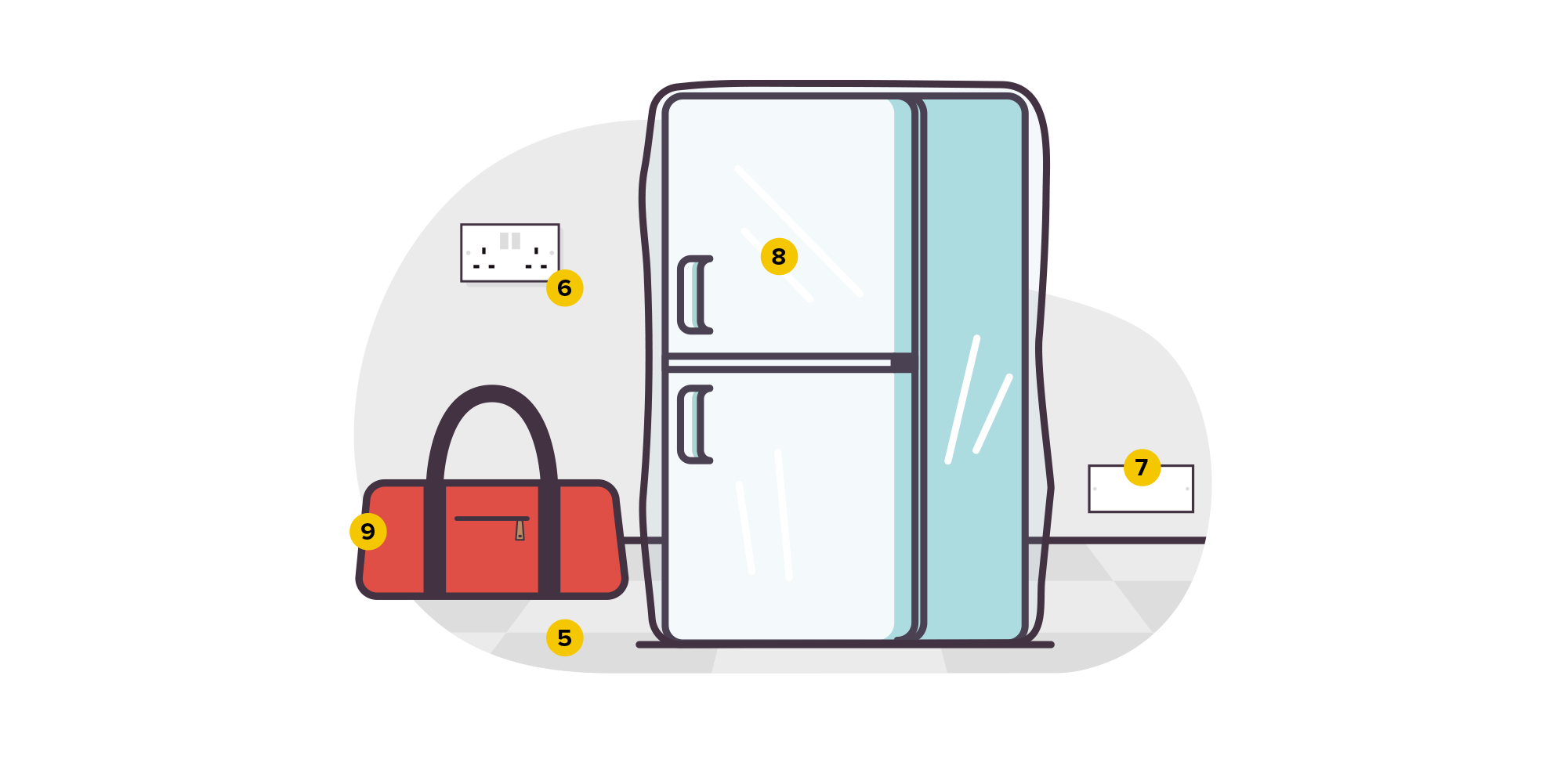

FLOOD DAMAGE PREVENTION CHECKLIST - INTERNAL

5. Flooring - Lay tiles instead of carpets or wooden floors

6. Electrics - Move electrical sockets up the wall and fit non-return valves

7. Airbricks - Fit self-closing airbricks or buy airbrick covers to stop flood water from entering

8. Protect large valuables - Buy large sealable bags for large items, e.g. electrical goods, sofas that may be too hard to move

9. Emergency grab bag - prepare a bag of essentials.

PREVENTION ADVICE

Find out what you can do to prevent damage to your home - in the long and short term.

HAVE YOU BEEN AFFECTED ?

If your home has been flooded, we understand how distressing it can be and we're here to help as best we can.

NEXT STEPS

1. Check your home insurance cover view policy documents.

2. Gather what you need to make a claim online

3. Make a claim online, it's quick and easy

4. Need to check an existing claim? You can manage it online

5. If you'd prefer to speak to someone, you can get in touch via our virtual assistant

FLOODING: WHAT IS AND ISN'T COVERED?

Not sure what your cover includes? Here's an overview.

Read more

Please note this relates to our standard Rias Home Insurance policy.

AFTER A FLOOD

If your home is affected, we're to help you deal with the impact of flooding.

Frequently asked questions

How do I make a claim?

We've outlined the steps that you should take if you need to check for water or storm damage and you need to make a claim.

How to make a claim

How do I check my cover?

If you need to know exactly what your home insurance covers, the quickest way is to check your policy documents. Here is a quick overview.

Do you need urgent support?

- Is your property uninhabitable or unsecured?

- Do you need to make us aware of any exceptional circumstances affecting you or someone you live with?

- If so, then please get in touch by calling 0345 165 5753 and we'll get you to the right person as soon as possible.

What is covered by storm damage?

- This will depend on the cover you have. If you have buildings cover, in the event of a successful claim, any part of your building which has been damaged as a result of the extreme weather will be covered.

- If you have contents cover, then any damaged contents will be covered.

- Policy limits are shown in your policy documentation.

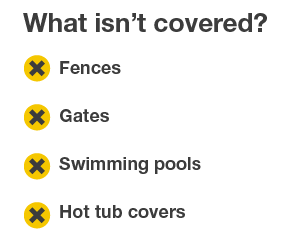

- Fences, gates, trees and hedges are not covered in the event of storm damage under your buildings cover. Please refer to your policy booklet as some garden items may be covered under contents cover if you have that.

What are buildings?

In insurance, Buildings are defined as the property shown in your insurance schedule/statement of fact. They include the structure of your home, including any fixtures and fittings, garden walls, gates, decking, paths, drives, patios, permanent swimming pools built of brick, stone or concrete, permanently fixed hot tubs, solar panels, fully enclosed outbuildings and hard tennis courts.

- Unless otherwise agreed, outbuildings do not include:

- Any building which is not on a permanent foundation or base

- Tree houses

- Inflatable buildings (whether over swimming pools or not)

- Any structure which is made of canvas, PVC or any other non-rigid material

PLEASE NOTE: Carpets are considered contents.

What is covered by buildings insurance?

This will depend on the cover you took out when you purchased your buildings policy.

Essentially, your standard buildings insurance policy will cover the cost of repairs to your home if it is damaged by an insured event such as theft, fire, flood and escape/leakage of water from pipes, storage tanks, etc. If you also purchased the optional add-on cover of Accidental Damage, that will cover you for other instances relating to accidental damage (which is damage that is unexpected and unintended, caused by something sudden and which is not deliberate).

There will be exclusions for each type of peril, so please refer to your home insurance policy booklet for full details of your cover.

What are contents?

Contents insurance will cover the items and valuables within your home that are not permanent features, fixtures or fittings of the building.

This will usually include things like your furniture, kitchen appliances, jewellery and entertainment systems.

Some items, such as carpets, may seem like buildings but are, in fact, considered contents.

If you are unsure what your item falls under and need to make a claim, get in touch with the Claims Team and they will be able to work this out for you.

What is covered by contents insurance?

This will depend on the cover you took out when you purchased your contents policy.

Essentially, your standard contents insurance policy will cover the cost of repairing or replacing the contents of your home if they are damaged by an insured event such as theft, fire, flood and leakage of water. If you also purchased the optional add-on cover of Accidental Damage, that will cover you for other instances relating to accidental damage (which is damage that is unexpected and unintended, caused by something sudden and which is not deliberate).

There will be exclusions for each type of peril, so please refer to your home insurance policy booklet for full details of your cover.

What if my property is not habitable due to the extent of damage?

We understand that some customers like to stay in their own homes where possible, so we can provide facilities like temporary kitchens and bathrooms to enable you to do so. If you do have to leave the property, we will help you make those arrangements, whether this is staying with relatives or checking in to suitable alternative accommodation.